child tax credit for december 2021 how much

Enhanced child tax credit. From July to December 2021 eligible families received an advance child tax credit of up to 300 per child.

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

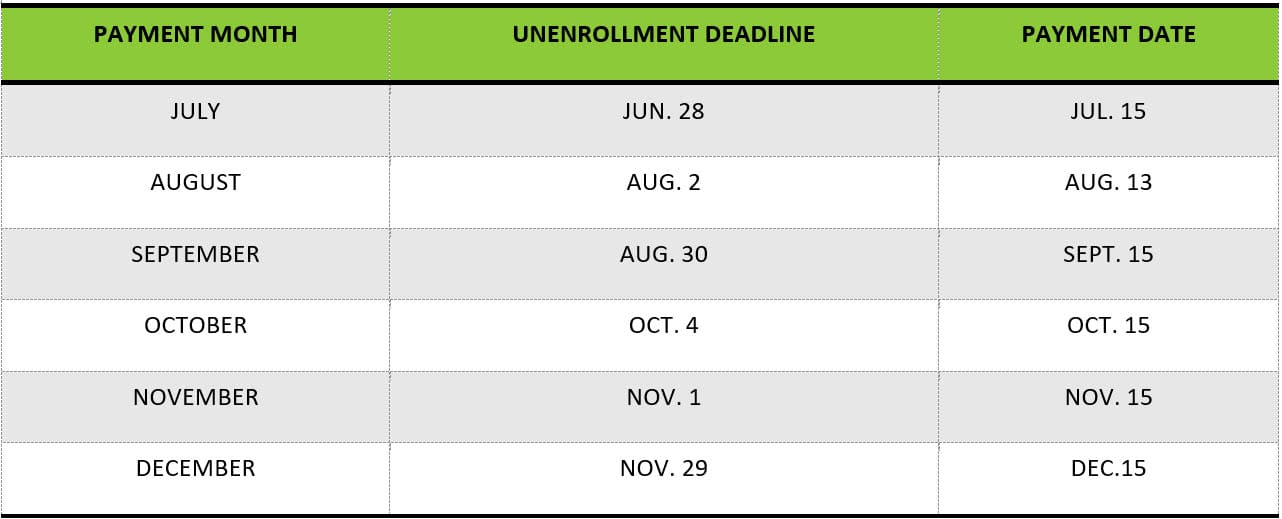

. Child Tax Credit Changes. A childs age determines the amount. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in. Since the child tax credit is refundable for 2021 many families have a chance to get a tax refund. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving.

The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. Put cash in your familys. A couple that makes about 100000 with two qualifying children under the age of six can expect to receive 7200 under the new plan.

How much money you could be getting from child tax credit and stimulus payments. Up to 3600 per child or up to 1800 per child if you received. To be eligible for the maximum credit taxpayers had to have an AGI of.

They would be eligible to receive 3600 in. The Child Tax Credit will help all families succeed. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27.

November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for. The tax credits maximum amount is 3000 per child and 3600 for children under 6. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child.

The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. Increases the tax credit amount. To reconcile advance payments on.

The 2021 CTC is different than before in 6 key ways. Child Tax Credit 2021. Have been a US.

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. But since the monthly CTC payments ended in December 2021at least for nowmany are. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child.

How much money you could be getting from child tax credit and stimulus payments. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The enhanced child tax credit. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. It helped roughly 60 million children and helped cut child. Enhanced child tax credit.

For 2021 eligible parents or guardians. In December these families will receive a lump-sum payment of 1800 for younger children under six and 1500 for those between six and seventeen. Up to 3600 per child or up to 1800 per child if you received.

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

2021 Child Tax Credit Advanced Payment Option Tas

One Remaining Child Tax Credit Payment For 2021 Make Sure You Re Enrolled For 2022 Wset

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Some Families Will Get 1 800 Per Child In Child Tax Credits In December Are You Eligible The Us Sun

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Why A Cut To The Child Tax Credit In 2022 May Not Be The Last

Newsletter Monthly Payments Are On The Way To Hardworking Maryland Families Congressman Steny Hoyer

Have Questions About The Advance Child Tax Credit Legal Aid

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

The December Child Tax Credit Payment May Be The Last

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet